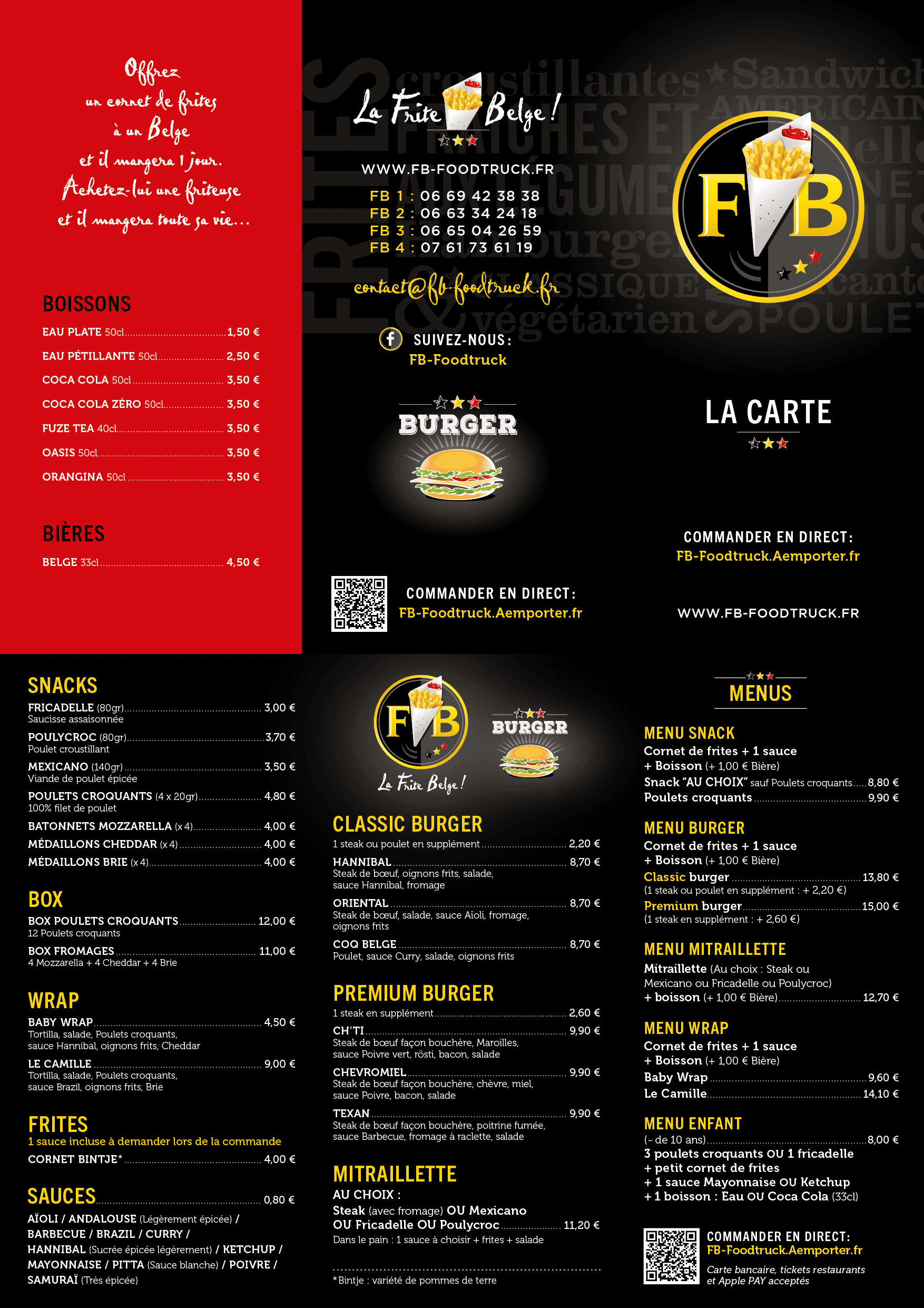

Bons plans

Voici nos solutions de fidélité

Commandez en Click & collect

150 € d’achat ( en 1 ou 20 commandes) = 10€ en CODE PROMO lors de votre prochaine commande sur le site.

En commandant directement sur https://FB-Foodtruck.Aemporter.fr, vos commandes sont additionnées et tous les 150 € vous recevez un CODE PROMO de 10 € à utiliser sur votre prochaine commande. Et en plus vous n’attendez pas devant le Food Truck, votre commande est prête. Vous gagnez du temps et pour nous c’est plus facile pour l’organisation !

https://fb-foodtruck.Aemporter.fr

Demandez la carte de fidélité

10 € atteint = 1 tampon : Uniquement pour les commandes en direct ou téléphone.

( 0 € à 19 € = 1 tampon / 20 € à 29 € = 2 tampons etc )

12 Tampons = 10€ de réduction !

N’oubliez pas de demander notre carte de fidélité lors de votre prochaine degustation !